California Paycheck Calculator: Estimate Your Net Pay Today!

Are you tired of deciphering the complexities of your paycheck, wondering where all your hard-earned money goes? Understanding your "take-home" pay, especially in a state like California with its progressive tax system, is crucial for financial planning and budgeting.

The journey of calculating your net pay can seem daunting at first. However, with the right tools and a little bit of knowledge, it becomes a manageable, and even empowering, process. This article will guide you through the essential elements of California paycheck calculations, demystifying taxes, withholdings, and the various resources available to help you understand your earnings.

California's state income tax system operates on a progressive scale, meaning the more you earn, the higher the percentage of your income that is taxed. This is in addition to federal income tax, social security, and Medicare deductions, making the final "take-home" pay a significant departure from your gross earnings. The state's income tax rates range from a modest 1% to a more substantial 13.30%, dependent on income brackets, with further modifications planned for 2025. These complexities necessitate a clear understanding of the calculations involved.

- Pasco County Arrests Jail Info Find Mugshots Bookings

- 1 Police Plaza Nyc Address Directions Info Ny Police Hq

Various resources can help you navigate these calculations. Online paycheck calculators are indispensable tools. Services like ADP and SmartAsset offer user-friendly interfaces where you can input your wages, tax withholdings, and other pertinent information. These calculators then estimate your federal, state, and local taxes, along with deductions for Medicare and Social Security, providing an accurate estimate of your net pay. These tools are beneficial for both hourly and salaried employees and can be accessed whenever you need a quick, reliable estimate.

Let's consider a practical example: Imagine youre a software engineer in San Francisco earning an annual salary of $120,000. To understand your take-home pay, you would first determine your gross pay per pay period based on your pay frequency (e.g., bi-weekly or monthly). Then, the relevant paycheck calculators would factor in federal income tax, California state income tax (which would be a percentage based on your income bracket), Social Security and Medicare deductions. These calculations, combined with any pre-tax contributions like 401(k) or health insurance premiums, determine your final net pay.

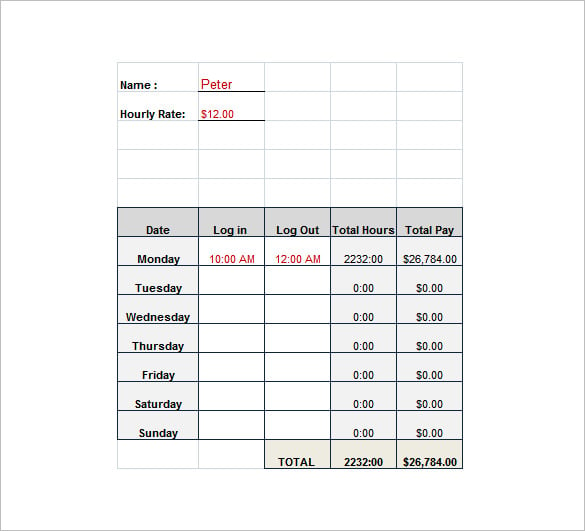

One of the key elements is determining the "pay type" whether the employee is hourly or salaried. The method for calculating taxes and deductions is the same, but the initial calculation of gross pay differs. Hourly employees calculate their gross pay by multiplying their hourly rate by the total hours worked, including overtime. Salaried employees, on the other hand, receive a fixed amount per pay period, determined by their annual salary. Regardless of the pay type, you'll then enter the wages and tax withholdings.

- Understanding Police Tape Uses Importance Your Guide

- Ben Shapiros Billboard Debut With Tom Macdonald Facts Latest News

California, like the federal system, requires employees to provide details like their W-4 form (for federal tax withholding) and a similar state form. These forms guide employers in calculating the correct tax amounts. The paycheck calculator tools incorporate these elements and the latest tax rates imposed by the government to ensure the calculations are precise. The information needed is not only the amount of the income but also factors like marital status, the number of allowances claimed, and any additional tax withholdings.

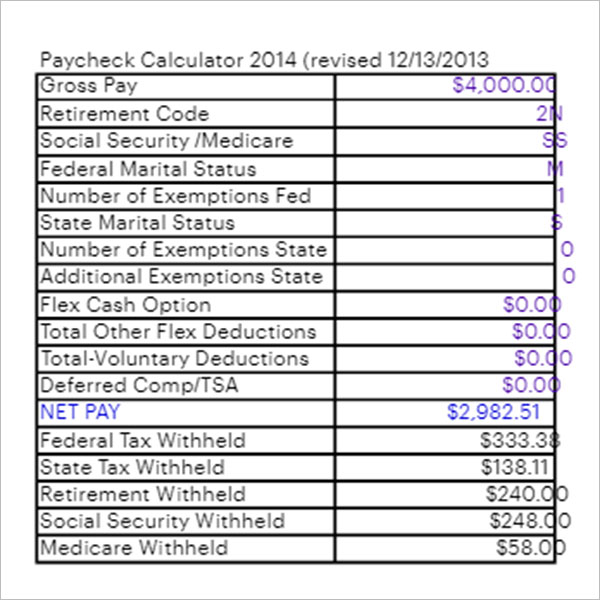

The process of calculating a paycheck, while complex, can be broken down into manageable steps. Here's a simplified breakdown. First, you determine the gross pay, which includes all earnings, tips, and bonuses, if any. Then, you calculate the federal income tax withholding, followed by California state income tax. Next, you calculate Social Security and Medicare taxes. Finally, factor in any pre-tax deductions, such as health insurance premiums or retirement contributions. The result is your "net pay," the amount you actually receive.

Paycheck calculators are a crucial part of the process. They often break down the information into easy-to-understand sections. The first part of the display shows the gross pay. The second part is used for calculating the paycheck, itemizing all deductions, and the third part, if available, provides a graphical representation of the data, making it simpler to visualize the information.

Several resources are available to help you. ADP and SmartAsset are just two of the many online paycheck calculators providing clear estimates of your take-home pay after accounting for all federal, state, and local taxes. These calculators are especially valuable for budgeting and financial planning. Also, don't forget about Roll's annual income calculator to get an understanding of yearly income.

California's income tax rates are a progressive system with rates that vary based on your income level. For 2024, rates ranged from 1% to 13.3%. Understanding how these rates apply to your situation is crucial for making informed financial decisions.

To summarize, calculating your paycheck in California involves several key steps: Determining gross pay, calculating federal income tax, calculating state income tax, calculating Social Security and Medicare taxes, and subtracting any pretax deductions. Utilizing online tools, such as paycheck calculators, is a simple and effective way to get a clear picture of your take-home pay.

Understanding the details of your paycheck allows you to budget better, plan for the future, and ensures that you are not just earning a living but thriving financially.

Here's a table summarizing some of the resources and elements discussed to help clarify the information:

| Category | Details | Tool/Resource | Purpose |

|---|---|---|---|

| Paycheck Calculation | Determine gross pay, federal income tax withholding, California state income tax, Social Security and Medicare taxes, pre-tax deductions. | ADP California Paycheck Calculator, SmartAsset Paycheck Calculator, Roll's Annual Income Calculator | Estimate your net pay (take-home pay) |

| Tax Rates | California's progressive state income tax rates vary based on income, ranging from 1% to 13.3% | California Franchise Tax Board Website | To understand applicable tax rates. |

| Wage Types | Hourly - pay based on the number of hours worked; Salaried - fixed amount per pay period. | N/A | To determine the method for calculating gross pay. |

| Deductions | Federal and state income taxes, Social Security and Medicare, and other items. | Paycheck Calculators | See the breakdown of deductions from gross pay. |

| Annual Income Calculator | Calculate an employee's yearly income after federal, state, and local taxes. | Roll's Annual Income Calculator | To calculate your yearly income after taxes. |

Finally, consider that you can check the details of the latest tax rates imposed by the government to calculate the correct taxes.

- 2025 Piaa Wrestling Championships Altoona Hosts Hershey No More

- Andrew Walker Age Wife Net Worth Hallmark Movies

California Paycheck Calculator 2025 Marius F. Rasmussen

11+ Free Weekly Paycheck Calculator Excel, PDF, Doc, Word Formats

The Ultimate California Paycheck Calculator Guide