California Paycheck Calculator: Estimate Your Take-Home Pay

Are you tired of the mystery surrounding your paycheck? Understanding exactly how much you'll take home after taxes is crucial for effective financial planning, and thankfully, a variety of online tools are readily available to demystify the process.

Navigating the complexities of payroll taxes can often feel like wading through a bureaucratic maze. Between federal, state, and sometimes even local taxes, along with various deductions, it can be challenging to predict the exact amount that will land in your bank account. Fortunately, a wide array of resources are accessible, empowering individuals to take control of their financial understanding and make informed decisions about their earnings.

One of the most essential tools in this financial arsenal is the paycheck calculator. These calculators are designed to provide you with a clear breakdown of your earnings, detailing the deductions taken from your gross pay and the net amount you can expect to receive. The availability of these calculators is particularly useful in states like California, which has its own set of tax regulations and deductions.

The state of California, with its significant population and diverse economy, presents a unique set of tax considerations for both employers and employees. The state income tax structure in California, categorized as progressive, ranges from 1% to 12.3% as of 2025. This means that as your income increases, the percentage of tax you pay also rises. This intricate tax structure necessitates the use of specialized tools, like California-specific paycheck calculators, to ensure precise calculations.

Many online platforms provide paycheck calculators tailored for California residents. For example, tools offered by Smartasset, ADP, and iCalculator are specifically designed to calculate net income, taking into account federal, state, and local taxes. These resources typically require you to input your gross pay, the number of allowances you claim, and any additional deductions, and then they instantly provide you with an estimate of your take-home pay.

Let's examine the fundamental components that contribute to the calculations of a paycheck:

- Oj Simpsons Children Where Are They Now Facts Updates

- Capricorn In 2nd House Financial Outlook Security Explained

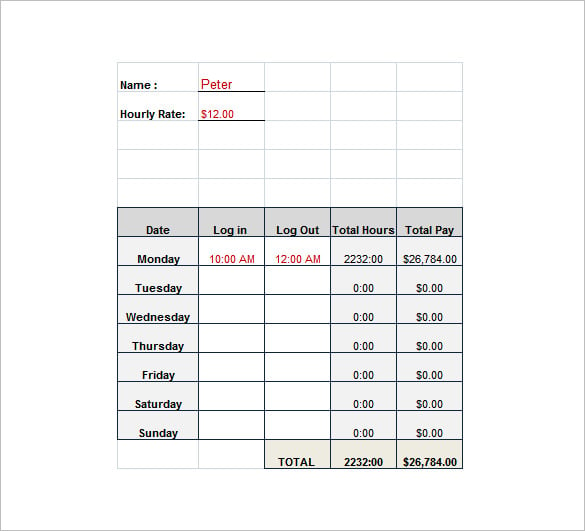

- Gross Pay: This is the total amount of money you earn before any deductions. It's calculated based on your hourly rate multiplied by the hours you work, or, for salaried employees, the annual salary divided by the number of pay periods.

- Federal Income Tax: The U.S. federal government levies an income tax on earnings. The amount withheld is based on your income level, filing status, and the number of allowances you claim on your W-4 form.

- California State Income Tax: California has its own income tax system, and the amount withheld is determined by your income level and the tax brackets in effect at the time.

- FICA Taxes: These consist of Social Security and Medicare taxes, which are mandatory deductions. The Social Security tax is typically 6.2% of your gross earnings, while the Medicare tax is 1.45%.

- Other Deductions: This includes items like contributions to retirement plans (401(k)s, etc.), health insurance premiums, and any other voluntary deductions you've authorized, such as union dues.

Several online platforms are available to perform these calculations accurately. Smartasset's California paycheck calculator is a widely used tool. It considers federal, state, and local taxes to give a clear picture of your hourly or salary income. Users simply enter their information to see their take-home pay.

PaycheckCity.com is another useful resource. It offers California-specific hourly paycheck calculators, tax calculators, and payroll information. These tools automatically calculate key information based on the employee's state of residence, allowing users to input additional details for precise pay calculations.

For a focused approach, iCalculator provides a paycheck calculator tailored specifically for California. This tool helps determine your net income per paycheck. ADP also offers a California paycheck calculator, allowing users to estimate net or "take-home" pay for hourly and salaried employees. Users input wages, tax withholdings, and other details to receive their estimated net pay.

For those managing payroll, PaycheckCity offers resources for managed payroll and benefits. Users can find California paycheck calculators, withholding calculators, tax calculators, and general payroll information.

The calculation process takes several factors into account. First, the gross pay is determined, for example, by multiplying hours worked by the hourly rate. Then, information like pay frequency (weekly, biweekly, or monthly) and the number of allowances are entered. Finally, additional withholdings are factored in to accurately estimate taxes and deductions.

California's progressive state income tax structure, which ranged from 1% to 12.3% as of 2025, must be considered in calculating income. The weekly California tax calculator is also available for quick salary comparisons, income tax reviews, and tax return estimations for weekly income.

Using the IRS tax withholding estimator is another way to ensure that you are having the correct amount of tax withheld from your paycheck. This is particularly important for employees in California, given the complexity of state and federal tax laws.

The changes in tax laws and regulations, like those affecting California government employees in 2021, can have a significant impact on pay and withholding. Using the paycheck calculator will help in determining those changes.

For those looking to prepare for tax season, e-filing your 2024 taxes with services like FreeTaxUSA can be a helpful way to manage the process. Services like these can often walk you through the necessary steps.

To further aid in understanding, here are some frequently asked questions about California payroll taxes and paycheck rules:

- What form do California employees fill out? California employees begin the process by filling out form DE 4.

- How are hourly rates calculated? Gross pay is typically calculated by multiplying the number of hours worked by the hourly rate.

- Can you add multiple rates in the calculator? Many calculators allow you to add multiple rates to accommodate situations where an employee may work at different rates.

These paycheck calculators are invaluable for employees and employers alike. They offer transparency, promote financial planning, and ensure compliance with tax regulations.

| Feature | Description |

|---|---|

| Purpose of Paycheck Calculators | To estimate net pay after federal, state, and local taxes, and deductions. |

| Key Inputs | Gross pay, filing status, allowances, and any additional deductions. |

| Calculation Components | Gross pay, federal income tax, California state income tax, FICA taxes, and other deductions. |

| Available Tools | Smartasset, ADP, iCalculator, PaycheckCity |

| California-Specific Considerations | Progressive state income tax rates, DE 4 forms, and various tax regulations. |

| Tax Estimator | IRS tax withholding estimator for accurate tax withholdings. |

| Benefits | Transparency, financial planning, and compliance with tax regulations. |

| Frequency | Weekly, Bi-Weekly, Monthly. |

Here are the tools that you can use for calculations

- Smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes.

- Use icalculator\u2122 us's paycheck calculator tailored for california to determine your net income per paycheck.

- Use adp\u2019s california paycheck calculator to estimate net or \u201ctake home\u201d pay for either hourly or salaried employees.

- Check out paycheckcity.com for california paycheck calculators, withholding calculators, tax calculators, payroll information, and more.

These tools are designed to simplify complex financial matters, empowering individuals and businesses to make informed financial decisions with confidence. By utilizing these resources, individuals and organizations can efficiently manage their finances, ensure compliance with tax laws, and gain a clearer understanding of their financial standing.

Remember, the use of these tools provides clarity regarding income and tax liabilities, leading to better financial planning and management.

- Breaking David Lebryk Leaves Treasury Amid Musk Clash

- Unraveling The Eric Rudolph Manhunt Deadly Games More

California Paycheck Calculator 2025 Marius F. Rasmussen

The Ultimate California Paycheck Calculator Guide

Calculate Paycheck Amount